WI DoR S-103 2021-2024 free printable template

Show details

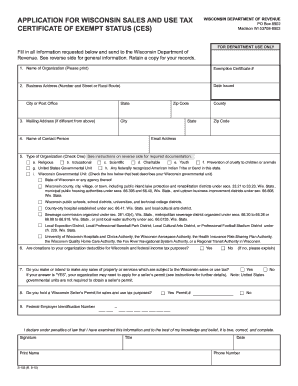

InstructionsSaveApplication for Wisconsin Sales and Use Tax

Certificate of Exempt Status (CES)PrintClearWisconsin Department of Revenue

PO Box 8902

Madison WI 537088902This form is for certain nonprofit

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your wisconsin application tax 2021-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wisconsin application tax 2021-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit wisconsin application tax online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form s 103. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

WI DoR S-103 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out wisconsin application tax 2021-2024

How to fill out form s 103

01

To fill out Form S 103, follow these points:

02

Start by providing your personal information such as name, address, and contact details.

03

Indicate the purpose of filling out the form.

04

Include any specific instructions or additional information required.

05

Sign and date the form after completing all the necessary sections.

06

Review the filled-out form for accuracy and completeness before submitting it.

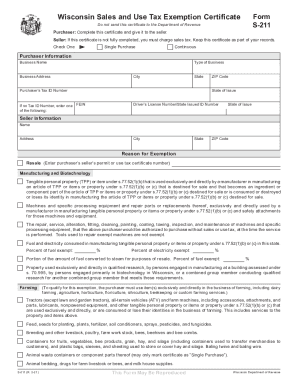

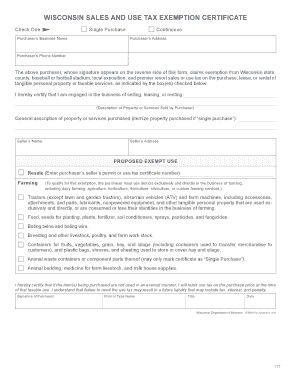

Who needs form s 103?

01

Form S 103 is needed by individuals or organizations who are required to provide specific information or instructions related to a particular purpose. It could be used for various purposes such as legal documentation, financial transactions, government reporting, etc.

Video instructions and help with filling out and completing wisconsin application tax

Instructions and Help about revenue wi gov forms form s 103

Fill wisconsin form s 103 : Try Risk Free

People Also Ask about wisconsin application tax

How often do you pay sales and use tax Wisconsin?

How do I apply for sales tax exemption in Wisconsin?

What is the use tax in Wisconsin?

What is exempt from sales and use tax in Wisconsin?

What is the sales and use tax in Wisconsin?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is s 103?

S 103 could refer to various things depending on the context. It is not clear what specific subject or topic you are referring to. Can you provide more information or clarify your question?

What is the purpose of s 103?

In order to accurately answer your question, I need additional information. Could you please specify which jurisdiction you are referring to?

What information must be reported on s 103?

The information that must be reported on Section 103 may vary depending on the context or jurisdiction. However, typically Section 103 refers to a specific section in a statute or regulation, so the actual information to be reported will depend on the specific statute or regulation being referred to. It is essential to refer to the respective statute or regulation to determine the exact reporting requirements.

What is the penalty for the late filing of s 103?

There is no specific "s 103" mentioned in the context of penalties for late filing. It is important to provide more information or context to accurately address your question.

How to fill out s 103?

Form S-103 is an Application for Application to Install a New Water Supply. Here are the steps to fill out the form:

1. Start by providing the required information in the top section of the form, such as the correct date, your name, title, organization, and contact details.

2. Next, indicate whether this is a new application or an amended one. If it is an amendment, provide the original application number and the appropriate section you are amending.

3. In Section 1, check the box that represents the water source type you are applying for, such as surface water, groundwater, or another type.

4. In Section 2, indicate whether you are applying for an individual service, community service, or both. Also, mention the number of users you anticipate.

5. In Section 3, describe the proposed water supply system, including its location, the source of water, and any treatment or storage facilities. Provide accurate details to ensure a clear understanding of your application.

6. Section 4 covers water quantity information. Include the estimated maximum daily demand (in gallons or other suitable units), any anticipated future needs, and details on water conservation measures.

7. In Section 5, mention any potential environmental impacts resulting from the project and describe the measures taken to mitigate these impacts. This could include considerations for wetlands, protected species, or other sensitive habitats.

8. Section 6 requires you to provide your construction schedule and estimated costs. Break down the costs into categories like land acquisition, treatment facilities, distribution system, etc.

9. In Section 7, provide a summary of the ownership status of the land or water rights you will use for this project. Specify whether it will include any leases or easements.

10. Section 8 is for you to describe any prior water rights or water management permits held by your organization related to this application.

11. Finally, sign and date the form in the appropriate section at the end.

Remember to review your completed form thoroughly before submission to avoid any errors or missing information. It may also be helpful to consult any instructions or guidelines provided by the relevant authority to ensure compliance and accuracy in your application.

How can I send wisconsin application tax to be eSigned by others?

When you're ready to share your form s 103, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit wisconsin s 103 straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing wisconsin ces, you can start right away.

How do I complete wisconsin form application on an Android device?

Use the pdfFiller app for Android to finish your wi form s 103. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your wisconsin application tax 2021-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wisconsin S 103 is not the form you're looking for?Search for another form here.

Keywords relevant to form s 103 wisconsin

Related to wisconsin sales tax exemption nonprofit

If you believe that this page should be taken down, please follow our DMCA take down process

here

.